The Epstein files are not getting a lot of attention now. The special military operation in Iran provides good cover for Trump and co.

There are so many Russians in Dubai, and now, they are experiencing some drone attacks. Not nice hey! But it is a walk in the park compared to what their countrymen have inflicted on Ukraine.

Ukrainians live under endless Russian strikes using various types of weapons. In the last week of winter alone, Russia launched more than 1,720 strike drones, nearly 1,300 guided aerial bombs, and over 100 missiles of different types against Ukraine.

Over the three winter months, the Russians launched more than 14,670 guided aerial bombs, 738 missiles, and nearly 19,000 strike drones against Ukrainians, most of them Russian-Iranian Shahed drones. These are the same drones that the Iranian regime is now launching at countries in the Middle East. But again, it is very mild compared to what Ukrainians experience just about every day.

The Iranians and their Russian allies had four years of target practice on Ukrainian cities to improve their Shahed drones. And most of the world smiled politely and thought it is just the Ukrainians’ unfortunate problem.

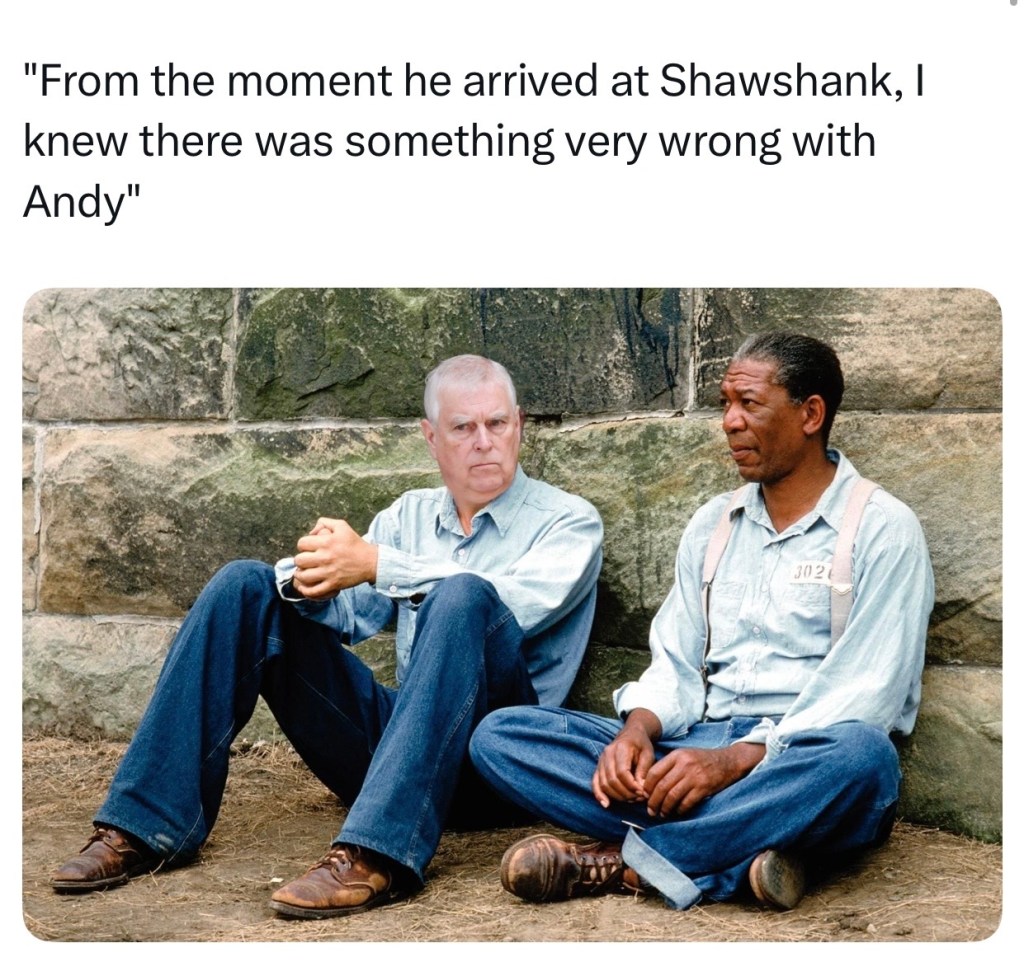

So let me get this right. The US can find and kill a leader of a foreign country halfway around the world. But they can’t find any of the paedophiles and child traffickers from the Epstein list and arrest any of them in their own country?

I will never forget that morning, around 5 am, when the bombs fell. It is still all so hard to believe. How can war be a part of modern life. But sadly, it is, and it is not going away. I fear a bigger war is developing. Of course, I pray I am wrong.

Ukraine deserves a better conversation in the world. I have been saying this for over 18 years. I do believe things are changing, but way too slowly.

We are busy with chapter 4 of Kyiv of Mine. It will be a darker story. The theme of this installment is “exhaustion”. This work helps me to say sane. Thank you to anyone reading this who has supported this difficult storytelling journey. Please help to spread the word as wide as you can. Ukraine needs all the love and support it can get.

Ukraine will not give up to its evil neighbour. But yes, there is a lot more pain to come. It is a big tragedy and we will all pay a price for all the double standards we have experienced, especially in the past year, since that bute Trump started his madness again.

“Democracy depends on citizens who participate, not spectators who wait.”

“Kyiv is the place where the destiny of the 21st century is going to be decided. If Kyiv stands then democracy stands. International law means something.”

I am on a train. It is a long journey back to London and I am sad to be leaving Kyiv, again. But I am looking forward to seeing Marta and Bunster. On that Sunday night, before I left for Ukraine, I was putting Bunster to bed and he says to me “Daddy, can we all go to Ukraine one day?” I look at him and said “I hope so Bun man”. He then says “Can we stay there forever?” I almost started to cry, but I know this naughty little Bunster and I say to him curiously, “How come you want to be in Ukraine?” And he says “Because my toys are there?” Ah, the honesty of children. I got a cool present for this little man from an awesome toy shop in the city – he is going to love it.

“The EU and the US alike — have taken far too long to cut off Russian gas and oil from world markets. The US government has stopped all military aid to Ukraine — what continues are shipments of US arms to Ukraine that are purchased by Europeans, as well as European arms shipments. Even though the Ukrainian need is great and the Europeans are paying for everything, the United States has been slow to make deliveries. We are not sending the Ukrainians the air defense they need to protect themselves. This is one reason millions of people are in the cold, and why civilians die almost every day.

The major policy of the Trump administration has been to use the word “peace.” Peace comes when an aggressor ceases to aggress and the country that is attacked can rebuild. But Trump has been unable to muster a policy that would change Russia’s incentives. He has difficulty even presenting the war as a war, rather than as a misunderstanding about real estate; his administration issues official statements that praise Russia for its desire for peace, even as the offensives continue missiles fall. Trump has put pressure on Ukrainians, who, unlike the Russians, have to fight. For Russia, this is an ego war, a war by a dictator for his own legacy. For Ukraine, this is a war of national sovereignty and physical survival.“

“Ukrainians shouldn’t have to be resilient. If Ukraine’s partners were to give the kind of support Kyiv continually begged for, civilians would not have to be suffering.

Praising their resilience is like standing on the shore, watching a person struggle not to drown in a riptide. Instead of sending a lifeboat to save them, you praise them for being such a strong swimmer. If you decide a nation is resilient, you shrink your obligation to take any action to help them.

Resilient people always figure it out on their own, right?

The continued repetition of a resilience narrative is also damaging because it slowly softens outsiders’ comprehension of what war is over time. Foreign audiences don’t want to think about the ever-deteriorating conditions civilians are forced to live in — they want to read about how bars stay open during a blackout, or focus on the ways in which Russia could be losing.

It’s uncomfortable to think about how the trauma of Russia’s war in Ukraine is affecting real people, every day, and how it will seep down through generations. It’s far more digestible to view the war through the lens of resilience because it transforms a nation’s suffering into a positive, hopeful, character-forming experience.

We love a story where a hero finds strength amid immense adversity, because in our culture, we’re taught that the character who chooses to be resilient always wins, no matter the odds.

Resilience is, at its core, a positive character trait when you have a choice in how to act. When we talk about Ukraine’s resilience, we omit what Ukrainians know very well — that Russia isn’t going to stop its war until Ukrainian independence is crushed. Ukrainians have no choice but to continue and resist Russia’s demands.”

As one might remember, last week Trump said that he asked Russian President Vladimir Putin to not strike Ukraine for a week, and Putin agreed to that. Days later, of course, Russia unleashed yet another mass aerial attack. When asked about that, Trump nevertheless said Putin “kept his word.” Kyiv groaned a collective “WTF?” at this. One Ukrainian politician aptly called it a “mockery of our misery.”

https://www.biznews.com/global-citizen/ronnie-aptekerukraines-war-feye-witness

This week saw the continuation of trilateral peace negotiations in Abu Dhabi, where representatives of Ukraine, Russia and the U.S. came together to discuss ending the war. This is the second round of this specific attempt at negotiations — hosted by the United Arab Emirates, and taking place after a reshuffle in the Ukrainian delegation. What we witness is a performance, meant for one spectator: U.S. President Donald Trump. The Ukrainian delegation is forced to go on with it to show Trump that Ukraine is not an obstacle to peace. Russia, on its part, uses the “negotiations” to buy time and not give the U.S. an incentive to introduce more sanctions or increase its backing of Ukraine.

I am back in Kyiv. It is very very cold, and everyone is on edge.

Electricity, heating and water are on and off, and who knows how much more the infrastructure can handle. If the evil Russians successfully strike more of the heating plants and electricity stations, then God knows how people are going to make it until the end of winter.

I am happy to be in Kyiv in our home here, but I feel alone. Perhaps it is the cold weather. Perhaps it is the mood. Perhaps it is the world. No one seems to care. I am sure people do care, but Ukraine certainly doesn’t get enough support. If they did, people would not be suffering like this. Children and the elderly are having a very difficult time. The country is exhausted. People are worried. The word “apocalypse” often comes up in conversation.

I was reading an update from an inspired writer I follow from the Kyiv Independent – I am cutting and pasting her words here :

“The resilience narrative is a trap. Not the idea itself – the actual daily practice of continuing under impossible conditions. That’s real, and it’s necessary, and we’re doing it because there’s no alternative. What’s dangerous is the way that word gets deployed by people watching from safety to make sense of our suffering. It’s a heroic term, an honorable one even.

But like all words that get used too much, it starts to obscure more than it reveals.

When you read about Ukrainian resilience, I need you to know: none of us here are doing okay. We are functioning, which is not the same thing. We go to work because rent is still due. We go to parties because the alternative is staring at walls, waiting for the next air raid siren. We maintain relationships, pursue careers, argue about restaurant choices, complain about traffic – all the ordinary friction of life continues because if we stopped to fully metabolize what’s happening, we would dissolve. We would become puddles of grief on the floor, unable to move, and that’s not a metaphor. That’s a real possibility we each avoid through sheer force of will and the accident of having obligations that won’t wait.

On top of every wartime worry – where is the person I love, will the power stay on, will that sound be thunder or something worse – people still carry all the peacetime worries too. The difficult neighbors, the failing relationships, the aging parents, the children who won’t sleep, the bills they can’t pay. The war doesn’t pause these problems, it just makes them harder to solve and less appropriate to mention in certain social circles.

So we continue. Not because we’re resilient, but because stopping means drowning, and we’ve decided – collectively, stubbornly, perhaps foolishly – that we’d rather stay afloat until the day we can finally breathe again.

That day comes when the Kremlin burns. Not metaphorically. Not diplomatically. Actually burns.

Until then, we tread water and call it living.”

It is totally surreal being here now. I will share more thoughts soon.